| « 6 months in Canada. | Features of Canadian documents. Part 2 » |

Canadian credit rating and how to deal with it.

In Canada, as in the USA, the credit rating system is widely used.

In our countries of the former USSR, there is also a credit rating system, but it usually only affects the ability to take out loans.

No one asks for it, for example, when renting housing or buying a SIM card.

I would even say that it is considered good manners not to have any credit cards or debts.

In Canada, it's just the opposite. You open a credit card, use it for payments, and raise your rating.

Sounds good, right? It is. If you're not an immigrant with no Canadian history.

Below, I'll describe my experience dealing with this system's challenges.

You start hearing about credit ratings for the first time when you encounter certain services.

For example, one common scenario is when renting housing. The company leasing the apartment may check your credit rating.

Similarly, when setting up home internet, they also ask for it. In general, there are more and more places where this happens.

My attempt to get a debit card at CIBC was successful right away. They opened the card without any issues and sent it by mail.

Excitedly, I began to apply for a credit card and received a rejection.

I also tried to open a Walmart store card, which offers bonuses on purchases and is also a credit card.

The result was the same:

I became upset... No, actually, I was just angry!

I won't even talk about why this system was created, maybe I'll write about it separately someday (if I can sum it up in a few words, it's definitely not out of good intentions).

After reading online, I found the following life hack.

There are several financial companies that help such losers enter this system.

All you need to do is fill out an application, confirm your identity, and deposit money there.

The amount you deposit becomes your credit limit on the card. Don't ask questions.

Essentially, you're giving yourself credit.

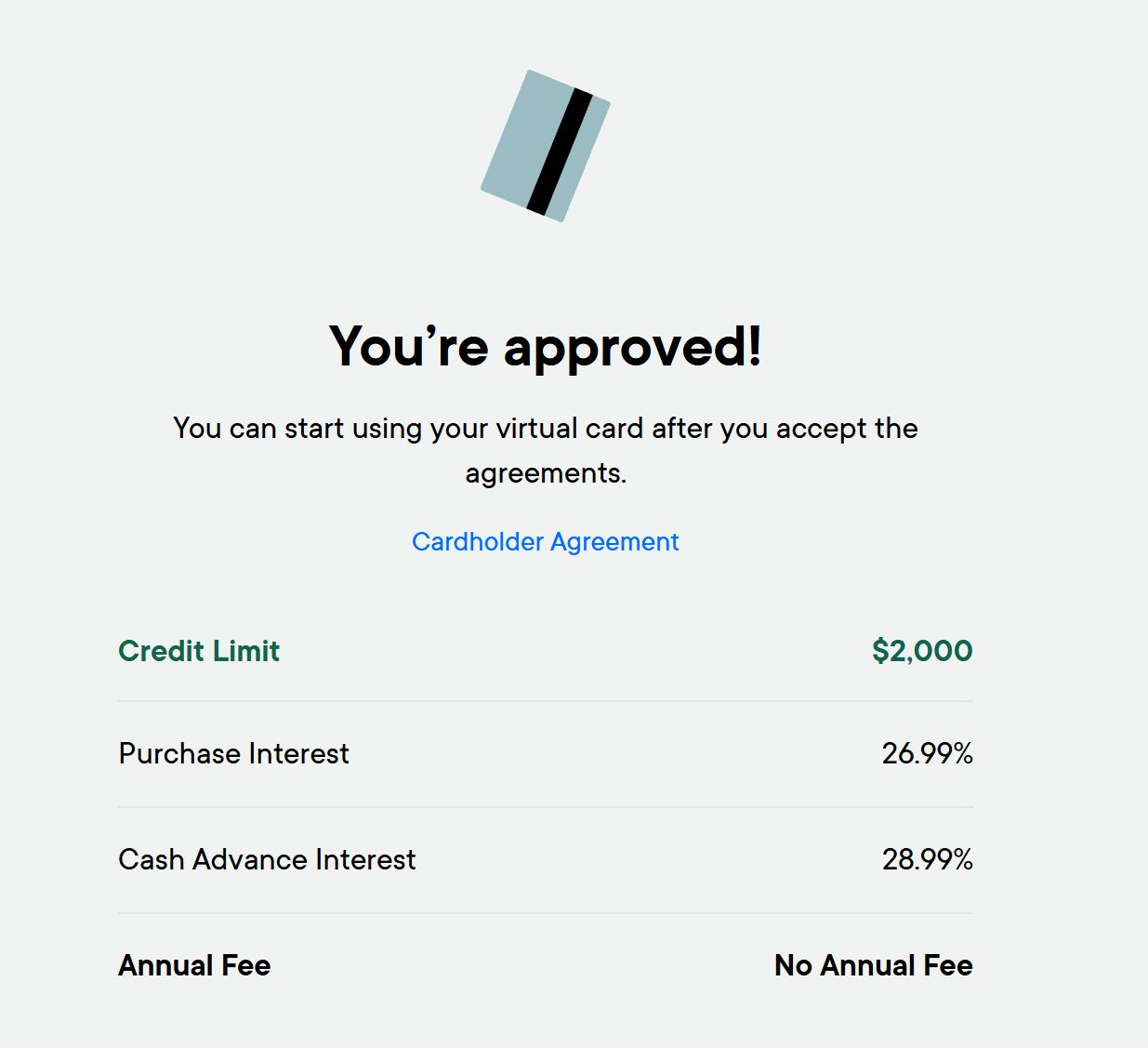

There aren't many companies like that. I chose NEO - they offer cashback and have a nice website.

Here's a referral link if anyone needs it.

Next, you'll need to set up automatic payments on your statement to avoid missing the payment date for your "credit."

If you deposit $2000, here's the calculation:

- Your credit rating improves when your spending is no more than 30% of the balance.

- You need to have the necessary amount in your account to pay off the "debt."

So, in total: $2000 - 70% = $600 that you can spend per month + $600 you need to deposit for repayment.

Your initial expenditure will be $2600.

After this, you'll start improving your credit rating and will be able to fully utilize banks, rentals, etc.

Good luck!

No feedback yet

Nikita

#IT #Explorer #ImmigrantSearch

Archives

- January 2026 (1)

- November 2025 (1)

- September 2025 (1)

- May 2025 (1)

- February 2025 (1)

- More...